salt tax cap news

At least hes trying. Clarity Labs is proud to be a CLIA- and CAP-accredited laboratory.

What The Property Tax Deduction Cap Could Mean For Taxes Credit Karma

Not in these quarters.

. Property Tax Relief Programs. Grand Jury Indicts Piscataway Corrections Officer 13 Others on Conspiracy and Assault Charges. TRENTON NJ Courey James 33 of Piscataway was among 14 corrections.

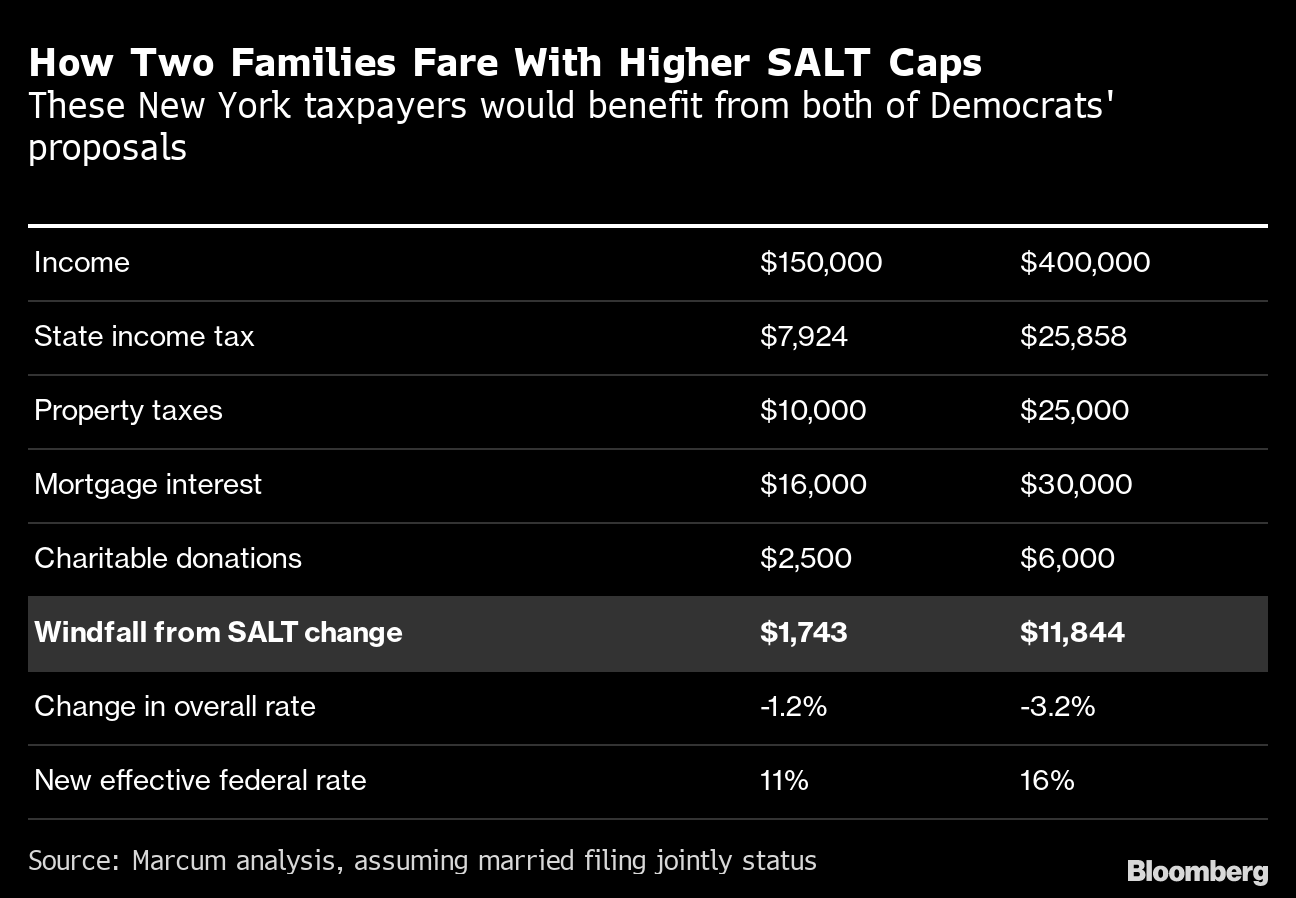

TAPinto - Local News Events Real Estate Obituaries. Taxpayers can deduct up to 10000 of. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro.

We will begin paying ANCHOR. News News Based on facts. The Supreme Court Monday rejected an appeal from several states challenging Congresss cap on state and local taxes that can be deducted from federal taxable income.

12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local.

Supreme Court wont review New York-led SALT deduction cap challenge. Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US. 2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the SALT cap.

December 12 2021 930 AM 4 min read. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms.

The deduction cap should be fully. The deadline for filing your ANCHOR benefit application is December 30 2022. Capitol on April 15 2021.

Dave Goldiner New York Daily News 1152021. Using the most medically advanced evidence-based profiles gives us a deeper understanding of each patients. Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000 federal deduction.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

States File Lawsuit Over Salt Deductions Cap

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

The Push To Repeal The Salt Cap The Long Island Advance

Appeals Court Rules Against Blue States In Lawsuit Over Salt Cap The Hill

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Unlock State Local Tax Deductions With A Salt Cap Workaround

Salt Relief House Votes To Kill Cap On Property Tax Deductions Housingwire

No Letup In Efforts By Nj Other States To Get Rid Of Cap On Salt Write Off Nj Spotlight News

The New Republican Tax Law Requires A Greater Response Than Salt Cap Workarounds

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post