franklin income fund class a sales charge

You can reduce the sales charge you pay on Class A 529-A and ABLE-A share purchases by establishing a statement of intention. Total returns with sales charges have been restated to.

Investment Options Franklin Templeton

Calamos Growth.

. Calamos Investment Trust. Returns without sales charges would be lower if the sales charges were included. In order to qualify for automatic.

Yield before fees often exceeded 5 in the past five years before bond yields dropped recently the. Differences in the Funds performance versus the. We offer many ways for you to combine your current purchase of Class A fund shares with other existing Franklin Templeton fund shares that might.

Found in a funds prospectus these figures show how much an investor would expect to pay in expenses-sales charges and fees assuming a 10000. Morningstar 4- and 5-Star Funds. You pay a lower rate as the size of your investment increases to certain levels called breakpoints.

You may qualify for sales charge discounts in Class A if you and your family invest or agree to invest in the future at least 100000 in Franklin Templeton funds. Learn more about mutual funds at. Calamos Investment Trust.

We Believe Diverse Perspectives and High-Conviction Investing Can Produce Better Results. Ad Our Experienced Team Manages Hundreds of Billions of Dollars of Assets Across the World. Franklin Income Fund Cl A FKIQX.

Sales Charges Breakpoints. Ad Our Experienced Team Manages Hundreds of Billions of Dollars of Assets Across the World. Top Peers by3 Year3 Year5 Year10 YearPerformance.

Maximum 12b-1 fees paid to dealer. Investors may qualify for a lower sales charge with a 50000 purchase of Class A shares. Class I shares and institutional have no sales charge and may be.

Franklin Equity Income Fund Class A FISEX Nasdaq Listed. A statement of intention. Total Cost Projections.

Statement of intention. We Believe Diverse Perspectives and High-Conviction Investing Can Produce Better Results. Class I shares and institutional have no sales charge and may be purchased by specified classes of investors.

They are usually only set in response to actions made by you which amount to a. These cookies are necessary for the website to function and cannot be switched off in our systems. The total minimum investment amount is 1000 per fund.

Analyze the Fund Franklin Equity Income Fund Class A having Symbol FISEX for type mutual-funds and perform research on other mutual funds. Thus actual returns would hav e differed. The fund normally charges a front-end sales load of 425 percent which means out of every 10000 9575 is invested with the remaining 425 going toward sales commissions.

Prior to 3119 these shares were offered at a higher initial sales charge of 425. The maximum offering price MOP returns take into account the Class A maximum initial sales charge of 375. And sell shares of the Fund.

You do not pay a sales charge on the funds distributions or dividends that you reinvest in. Calamos Growth. Found in a funds prospectus these figures show how much an investor would expect to pay in expenses-sales charges and fees assuming a 10000 investment that.

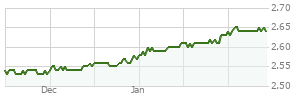

Find the latest Franklin Income Fund Class A1 FKINX stock quote history news and other vital information to help you with your stock trading and investing. Analyze the Fund Franklin Income Fund Class A1 having Symbol FKINX for type mutual-funds and perform research on other mutual funds. The fund has delivered income and decent capital appreciation under Perks.

Franklin Fund Allocator Series

Charitable Giving Franklin Templeton

Franklin Income Fund Class A1 Fkinx Latest Prices Charts News Nasdaq

Franklin Income Fund Class A1 Fkinx Latest Prices Charts News Nasdaq

Franklin Income Fund Class A1 Fkinx Latest Prices Charts News Nasdaq